As mentioned in last week’s newsletter we have several funders that have similar product options. This email is the first of a series attempting to explain the differences between the products that we offer.

First up the Prime Lo Doc options available.

Today, I will try to explain the differences between our Pinnacle & Easy Prime Lo Doc products.

The Easy & Pinnacle products offer both Prime & Specialist options.

- When would you consider a Lo Doc for your customer?

When you have a self-employed applicant, who has not completed their Financials for the past couple of years.

- Prime Lo Doc loans are only available to applicants that have been running their own business or businesses for more than 2 years.

- Applicants who have no credit issues or late payments evidenced in any of their loan accounts.

- With security properties generally located in Cat 1 locations.

*Please note income declarations are to be based on income earned in the past 12 months and not on projected income.

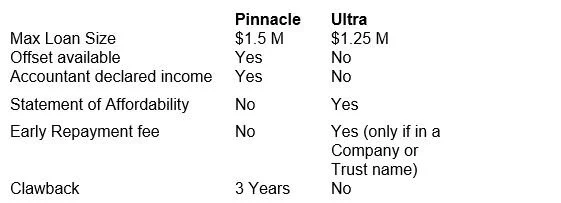

The main differences between our Pinnacle Prime & Ultra Lo Doc products are as follows;

Both options have other alternate income verification options, by providing a minimum of 6 months BAS, or 3 to 6 months Business Bank statements.

Purposes:

- Cash out is only limited by the loan amount or maximum loan size.

- Refinance

- Debt consolidation

- Purchase of Property for Owner Occupation, Investment, Business, Business Equipment, or Assets for Personal use.

If you have any scenarios you would like to discuss, please email me at scenarios@australianfinancial.com or ring me.